File Chapter 7 Bankruptcy with $0 Down Las Vegas, Nevada

$0 DOWN CHAPTER 7 BANKRUPTCY PAYMENT PLANS

When you are faced with a debt situation that requires immediate attention, chances are you’re not be ready for the costs of retaining an attorney. Thus, if you need an emergency bankruptcy to stop a garnishment, prevent a repossession, or to save your home from foreclosure, we can help RIGHT NOW. Even if you don’t have the money up-front to file your Chapter 7, Vegas Bankruptcy Lawyers can help you. How? If you qualify for our $0 down Vegas bankruptcy payment program, you pay no money down. The remaining fees are paid through an agreed monthly payment schedule over time. Contact our Las Vegas bankruptcy lawyer for a free consult. Call our Nevada Ch 7 Attorneys today (702) 370-0155.

CHAPTER 7 BANKRUPTCY IN LAS VEGAS – WHAT YOU NEED TO KNOW

Individuals and businesses with overwhelming debt often seek Chapter 7 bankruptcy protection, commonly called liquidation or straight bankruptcy. While considering Chapter 7 bankruptcy, it is advised that you contact our Las Vegas Bankruptcy Lawyer for a free debt evaluation. In order to file Ch 7 bankruptcy in Las Vegas, one must meet eligibility requirements. Next, if this debt relief option is right for your specific debt situation, our experienced legal team provides the representation necessary for a successful resolution to your bankruptcy case.

Chapter 7 is referred to as a straight bankruptcy. It is a straightforward process that allows a debtor to discharge, or erase most debts. Therefore, retaining a fresh start and a clean financial slate is paramount. Also, a chapter seven bankruptcy discharges many types of financial obligations. Plus, after eliminating these debts, individuals, (then begin rebuilding credit and finances) eliminate the stress of late payments, wage garnishments, potential repossession or foreclosure, and lawsuits stemming from debt.

FILING FOR BANKRUPTCY STOPS CREDITORS FROM COLLECTING ON A DEBT

Immediately after Las Vegas Bankruptcy Lawyers files a bankruptcy petition on your behalf, the automatic stay goes into effect. The stay is part of the legal process which prevents creditors from taking any action to collect on most kinds of debt. An automatic is a power debt relief tool.

Once your case is filed with the Bankruptcy Court, collection action such as foreclosures, lawsuits, harassing phone calls or other attempts to collect debt, wage garnishments, and repossessions must stop.

Nevada Bankruptcy Chapter 7 Attorney

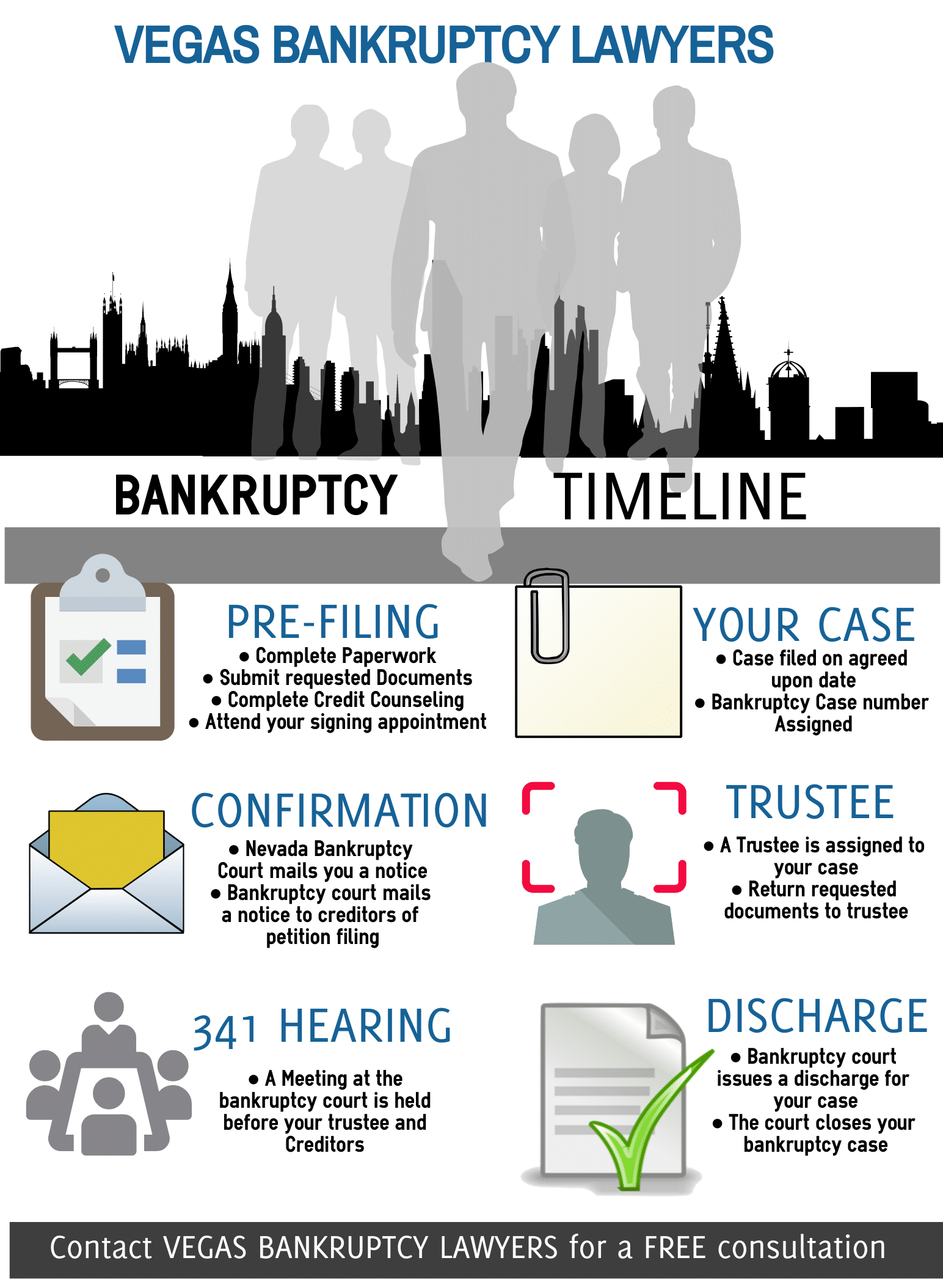

The majority of Chapter 7 case filings give a complete fresh start; especially, when you erase debt, and receive a bankruptcy discharge. At Vegas Bankruptcy Lawyers, a professional attorney assists you with the bankruptcy petition filing and documentation. Also, your lawyer helps you understand the process of BK and guides you through it from filing to discharge. Thus, after wiping out your debt, it is important to us you rebuild your credit and improve your credit score. Plus, our Nevada debt relief firm provides you with the information you need to get your credit back on track, now that you have your debt cleared up.

Additionally, Vegas Bankruptcy Lawyers protect your rights. Plus, we constantly communicate with you throughout the process. Contact us to find out if you qualify for Chapter 7 bankruptcy in Vegas, and to schedule your FREE debt evaluation and consultation with an attorney.

DEBT THAT CAN BE DISCHARGED OR ERASED IN CHAPTER 7

Of course each bankruptcy case is different. Each presents unique debt circumstances. Therefore, in order to completely understand the nature of your debt and the advantages of eliminating debt by filing bankruptcy protection, contact our law firm and discuss your case with an experienced attorney. Our firm offers a FREE CONSULTATION with a Chapter 7 bankruptcy attorney. We also have a Zero Down Chapter 7 option. Emergency Chapter 7 Filings. Plus, Medical Debt Bankruptcies.

WHAT IS A LAS VEGAS CHAPTER 7 BANKRUPTCY?

A Chapter 7 Bankruptcy allows you to erase many financial debts and obligations. Plus, after successfully completing the bankruptcy process, the Bankruptcy Court grants a discharge. Also, this means you will not have to pay back certain debts. In many cases, the bankruptcy discharge will leave you totally debt free and ready for a clean slate an new financial beginning. Additionally, declaring bankruptcy in Nevada is the easiest way to become debt free. Therefore, get in touch with a bankruptcy or debt relief attorney today.

Additionally another benefit of a Nevada Chapter 7 is being able to keep most of your personal property while eliminating debt. Chapter bankruptcy attorneys in Nevada would be of great assistance.

Other benefits of Chapter 7 bankruptcy protection STOPS:

- creditors from calling you, contacting you, or attempting to collect a debt

- a foreclosure

- any judgement against you for a debt owed

- payday loans

- a wage garnishment

After filing a Chapter 7 in Nevada, the “Automatic Stay” kicks in and all collection efforts legally have to stop.

Nevada Chapter 7 Bankruptcy Lawyer

AN EXPERIENCED LAS VEGAS CHAPTER 7 BANKRUPTCY ATTORNEY

LAS VEGAS CHAPTER 7 BANKRUPTCY FAQs

Is Chapter 7 Bankruptcy Right For You?

A Las Vegas bankruptcy is usually a good option for people whose debt is out of control and few significant assets. Also, a Nevada ch 7 bankruptcy can be used to eliminate high medical bills. Plus, it is impactful on payday loans. Many Nevadans use it when unemployed. Also, for debts of a recent divorce, high interest credit cards, and many other debts. Specifically, Chapter 7 bankruptcy has many benefits.

In Las Vegas, people filing for bankruptcy protection get a fresh start and an opportunity to again move forward debt free. Contact our Las Vegas bankruptcy lawyer; specifically, to find out if declaring bankruptcy is the best option for you and your family. We offer free consults and same day filing options.

Additionally, there are many myths associated with a ch 7 bankruptcy, don’t believe them! The ch 7 bankruptcy truth is you can usually keep your home, your car or truck, and your personal property. Plus, After a Nevada chapter 7 bankruptcy it is important to work on rebuilding your credit. Vegas bankruptcy lawyer Erik Severino can help. He will eliminate your debt, get your finances back on track, and assist you in reestablishing your credit.