Emergency Bankruptcy Services in Las Vegas

Automatic Stay Halts All Collection Action

Emergency Bankruptcy Services in Las Vegas

Automatic Stay Halts All Collection Action

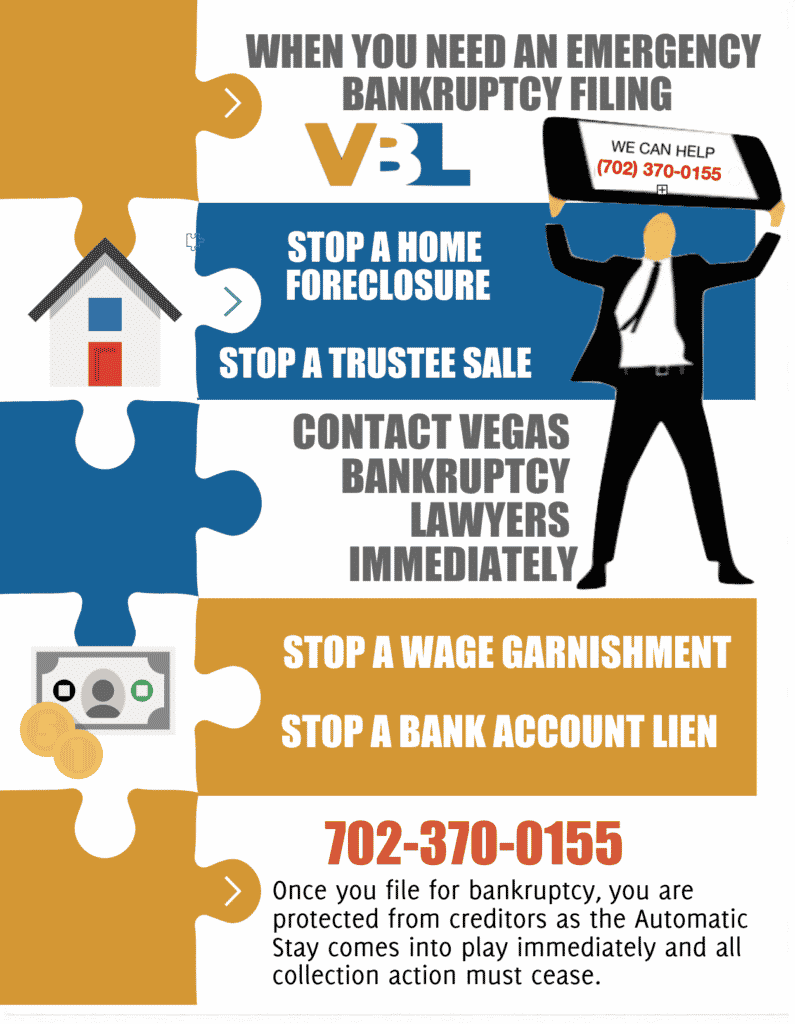

Emergency bankruptcy filings are sometimes a necessity. No one wants to file for bankruptcy. However, sometimes it is the best move for your financial situation. Sometimes, the situation requires that you file bankruptcy right away! Circumstances like those our Las Vegas debt relief firm call Emergency Bankruptcy Filings. Bankruptcy provides you are protected from creditors as the Automatic Stay comes into play immediately and all collection action must cease.

Las Vegas Bankruptcy Law Firm Offers Bankruptcy Filings for Emergent Situations

Contact our Las Vegas bankruptcy lawyer to find out how our Nevada bankruptcy attorneys can use Emergency Bankruptcy services to stop a trustee sale or foreclosure sale, wage garnishments, bank account liens, and other disruptive financial or real estate activities by declaring bankruptcy on your behalf with short notice. Filing for bankruptcy in Nevada is also helpful in stopping eviction from a residence by an owner or landlord.

In situations where bankruptcy is the last minute action to stop such collections activities, our attorneys have successfully helped hundreds of clients who have found themselves in an “Emergency” type of situation by utilizing our debt relief services. If you are looking to stop a trustee sale, stop a bank account lien, or get rid of a wage garnishment; consider filing for bankruptcy protection before it is too late.

Filing Emergency Bankruptcy to Stop Bank Account Lien in Nevada

Upon granting a judgment to your creditor, they may take action to apply a lien on your bank account. Also, creditors can even levy your bank account to take funds right out of the account. Bankruptcy can stop this collection activity before it happens. An automatic stay will freeze any collection activity. Filing bankruptcy can discharge the debt so that the collection will not happen in the future.

Emergency BK Filing to Stop Foreclosure in Henderson and Las Vegas

Trustee sale or foreclosure sale are seemingly out of your control. However, you can take back control of the situation by filing a bankruptcy. And, at the same time, stop any other collection activities and discharge your debt.

A filing for bankruptcy protection, grants an automatic stay from the bankruptcy filing. The automatic stay is in effect upon filing of a bankruptcy and can stop a foreclosure sale from happening. Our Las Vegas and Henderson bankruptcy lawyers can usually stop a foreclosure sale even if the sale date is the next day. That being said, it is not advised to wait until the last minute. Don’t wait until it is too late. Notify us as early as possible to stop your foreclosure sale.

Emergency Bankruptcy to Stop Wage Garnishment in Henderson and Las Vegas

You can stop a garnishment after it has started. Even if you have an active wage garnishment that is regularly taking place, you can still stop any further collection from your paycheck by filing a bankruptcy. Therefore, if your active wage garnishment has not yet begun, you can stop the collection from your paycheck before distribution of any funds. Thus, don’t let any of your hard earned money go to waste in a wage garnishment. Filing bankruptcy in Las Vegas will immediately stop a wage garnishment as the automatic stay will go into place.

EMERGENCY BANKRUPTCY FAQs

It’s Not Too Late

Regardless of your situation, there is usually something that can be done. If you currently have a wage garnishment, stop the garnishment before they take any more of your earnings. Also, if you are currently dealing with a house foreclosure, file an emergency bankruptcy and stop the sale of your family home. In situations where a bankruptcy filing is needed immediately it can happen through what our Las Vegas and Henderson bankruptcy attorneys call an emergency filing.

Offering Free Emergency Bankruptcy Consultations in Las Vegas

Our Las Vegas bankruptcy attorney offers free consultations. Call now (702) 370-0155. We offer either in office or phone consultations, your choice. We can explain the bankruptcy process. Let us show you what bankruptcy can do for you based on your own, personal situation. In just one consultation, we’ll listen to your financial situation, offer solutions, and explain the bankruptcy process. Our Nevada debt relief team is here to answer your questions.

Customer service is priority #1. We want you to be confident in our services and know Erik Severino as he will be your attorney as you plan on filing bankruptcy in Henderson and Las Vegas. Erik is an experienced bankruptcy lawyer and has filed thousands of successful Nevada bankruptcies.