Wage Garnishment Lawyer in Las Vegas

Let our Las Vegas Garnishment Attorney Stop Your Wage Garnishment

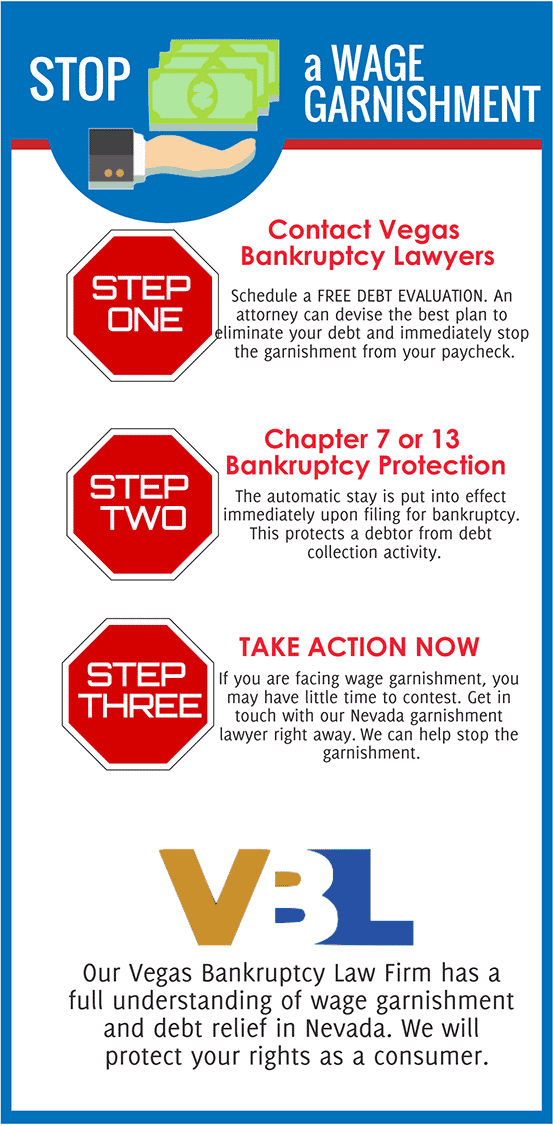

Facing a wage garnishment in Las Vegas? Our Las Vegas bankruptcy lawyer can stop that garnishment immediately. Put simply, declaring bankruptcy can terminate wage and other garnishments and stops most law suits.

Also, filing for bankruptcy puts a quick end to judgements and garnishments. Therefore, once your Las Vegas bankruptcy is in place and makes it so a garnishment can’t be filed if they the creditor hasn’t done so yet.

Automatic Stay

Wage Garnishment Triggers an Automatic Stay

Vegas bankruptcy, both Chapter 7 bankruptcy and Chapter 13 bankruptcy, put an “automatic stay” on the actions of creditors. Therefore, an automatic stay stops creditors from collection action such as wage garnishment proceedings.

Plus, during the Automatic Stay, a debtor can take the time to reorganize debts and find reasonable solutions through the debt relief of chapter 7 bankruptcy or chapter 13 bankruptcy. The automatic stay allows them the time to get their finances back on track. It also stops wage garnishments and collections so the bankruptcy filer has their full complement of a paycheck to work with going forward.

Under the “automatic stay” provision of the bankruptcy code (11 U.S.C. 362), a creditor must immediately cease-and-desist from:

- Pursuing a Wage Garnishment or the continuation of an existing wage garnishment.

- Cease Initiating a lawsuit after an individual has filed bankruptcy.

- No Longer Continuing to pursue an existing lawsuit after a bankruptcy filing.

- Desist from placing a lien against a home or other property.

Wage Garnishments Lead to Additional Trouble

Garnishments usually accompanies other financial problems in a person’s world such as possible home foreclosure, fear of vehicle repossession, and potential liens on a home or properties. Wage garnishment can be crippling to a person’s day-to-day life as they literally have up to 25% less money to pay bills and work with in life.

While declaring bankruptcy can seem intimidating, it truly provides one of the most reasonable and accessible options for solving such problems like a garnishment of wages. Hence, an experienced Las Vegas bankruptcy attorney can advise you as to how to immediately stop a garnishment and the other benefits of filing for bankruptcy.

Additionally, the automatic stay goes in effect as soon as you file for bankruptcy. You work hard for your money, don’t let a creditor take part of your paycheck with a wage garnishment. Contact our Las Vegas Wage Garnishment Attorney today for a free consultation and advice on stopping a garnishment.

HENDERSON WAGE GARNISHMENT FAQs

Wage Garnishment Lawyer in Las Vegas

In Nevada, creditors have the right to garnish the wages of those who fall behind on unpaid bills. This is per the debt collection process in Nevada. If you owe a person or a bank or company money, they can bring a lawsuit against you and obtain a court judgment against you.

Once a judgement in obtained, should you refuse to pay the judgment, the judgment creditor can then start the process of garnishing your wages. In Nevada, there are few ways to stop a garnishment. One method of stopping a garnishment is that you can argue that your income is exempt or that you will suffer extreme hardship. These arguments are occasionally successful. As a last resort, you may also file for bankruptcy which immediately stops the wage garnishment in place against you automatically.

Hence, creditors must get a judgement against an individual before getting a garnishment. Unfortunately, getting your wages garnished is an increased burden on people already in a tough financial situation.

Nevada Wage Garnishment Attorney Erik Severino has helped thousands of people in Las Vegas. As well as, throughout Nevada to stop wage garnishments and relieve debt through filing chapter 7 or chapter 13 bankruptcy. Eric and the Vegas bankruptcy team commit to working with you to obtain debt relief and stop garnishments. Keep in mind, if a creditor has a judgement against you or you are facing a wage garnishment, call us at (702) 370-0155.

Legal Wage Garnishments in Nevada

Our Bankruptcy Attorneys Can Help Stop a Garnishment

Many times wage garnishments happen to good people. They don’t even realize that either a judgement or a writ of garnishment has been put in place against them. Not knowing that a garnishment looming can lead to nightmare scenarios.

Garnishment Nightmare Scenario #1: Your bank account balance on payday. Instead of the hundreds or thousands of dollars you may expect to find, you find a ZERO BALANCE.

Garnishment Nightmare Scenario #2: You get your paycheck. Instead of a full check amount, you find that you have been paid 25% less than your typical wage.

What has happened?? Are you a victim of some sort of fraud? Has someone hacked your bank account? Has Criminal actions happened to you? Perhaps, this is a case of identity theft or mistaken identity?

The more realistic answer is … No. Chances are good that you are a victim of legal garnishment in Nevada. If you find yourself in the middle of a garnishment, you should seek legal assistance at one.

Legal garnishment, once established, makes it possible for creditors to remove money from your account without your knowledge. A Nevada legal garnishment can also result in up to a 25% reduction of your pay from your work. A legal garnishment will continue and be attached to each paycheck until the judgment is satisfied.

Las Vegas garnishments are powerful tools used by creditors to collect debt from people who owe money. They need to be dealt with gravity and seriousness. Contact our Las Vegas garnishment attorney for additional assistance.