Nevada Bankruptcy Attorneys help families file for BK in Nevada

Qualifying for Chapter 7 Bankruptcy

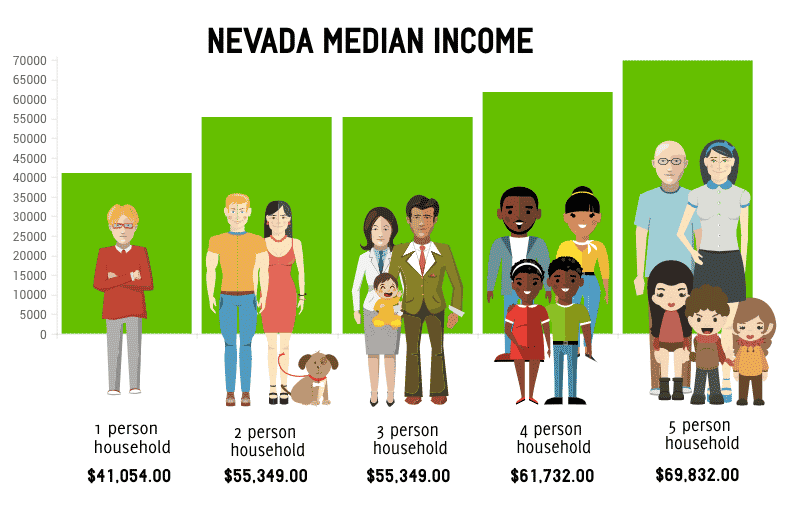

In Nevada, there are two ways to qualify for a Chapter 7 bankruptcy. The first is by making less than the state median income based on how many family members you have. Only spouses and minor children will be included as your family members. The median income in Nevada starts at $52,449 for a single filer with no dependents. It increases to $65,756 for an additional family member, $74,856 for a third, and so on.

The Bankruptcy Means Test

If You Don’t Qualify for Chapter 7, You May Qualify for Chapter 13

YOU PAY NO $ DOWN

UNTIL YOUR CASE IS FILED

Subsequent Bankruptcy Filings

Another thing that can disqualify you from filing for bankruptcy besides your income is if you have already filed before. There are waiting periods between filing that depend on which chapter you previously filed and which chapter you wish to file. You will need to wait 8 years after the filing date of your first Chapter 7 bankruptcy before you are eligible to file again.

Bankruptcy Discharge

Except in rare (usually Chapter 13) cases, the goal of filing bankruptcy is to achieve discharge. When debts are discharged, you are no longer obligated to pay them. In a Chapter 7 bankruptcy, it is usually 3-6 months from the filing date until your debt is discharged. In Chapter 13, you will need to complete the final payment in your 3-5 year payment plan before you are eligible for discharge.