Chapter 13 Bankruptcy FAQS in Las Vegas, Nevada

People choose to file for bankruptcy for many reasons. Whether an unexpected emergency expense creates a hole of debt the filer can’t escape on their own, or they fall behind on payments for assets they don’t want to lose, Chapter 13 Bankruptcy in Las Vegas, Nevada can help people in debt in ways that Chapter 7 Bankruptcy and other non-bankruptcy procedures can’t.

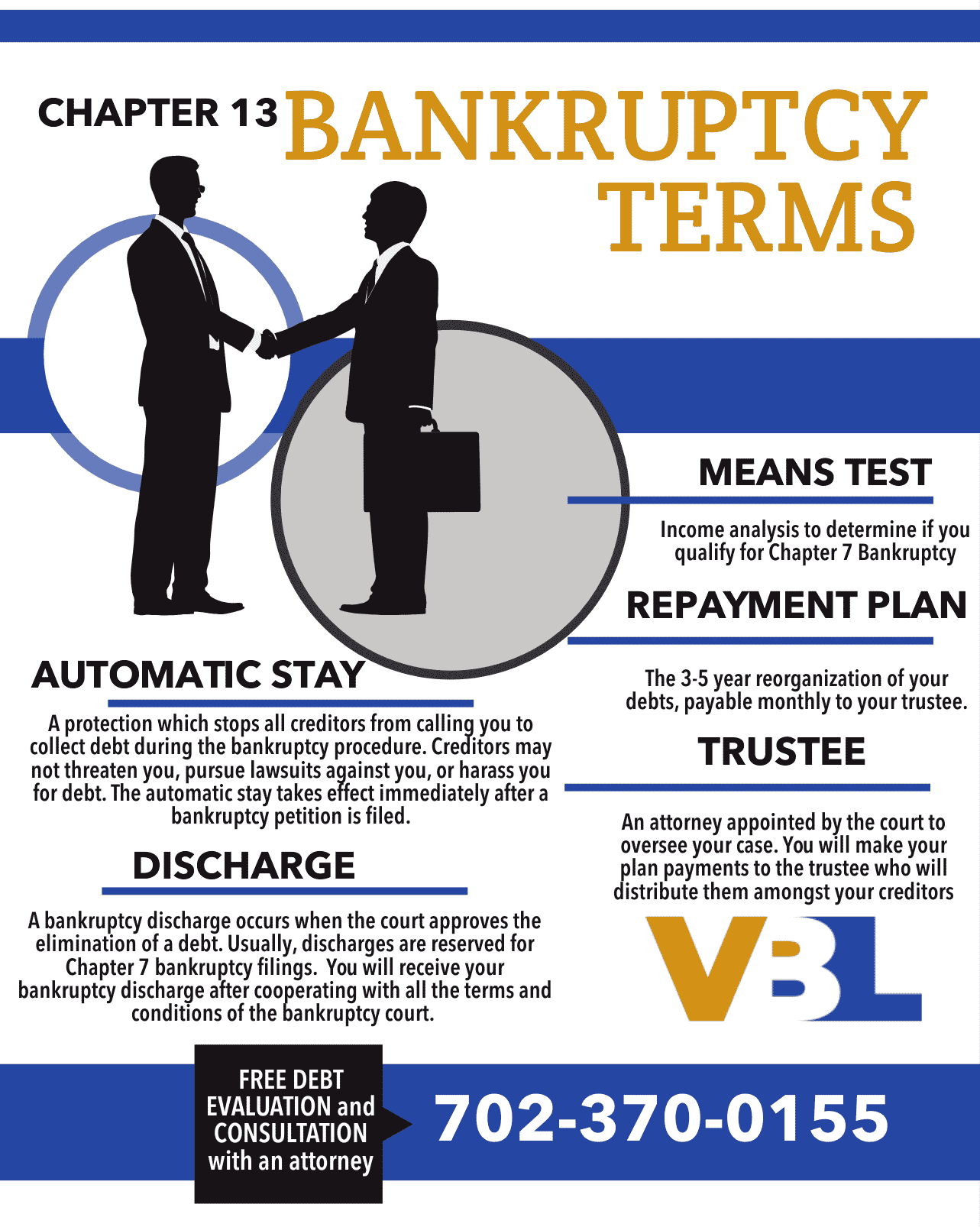

Chapter 13 is a 3-5 year reorganization payment plan. Whereas, debts are automatically discharged without repayment in a Chapter 7 . Plus, Chapter 7 Bankruptcy has strict income and asset exemption limits that don’t apply in a Chapter 13. Although, the filing fee is lower in a Chapter 13, ($310) but legal representation fees are typically much higher than in a Chapter 7. Additionally, Chapter 13 allows the possibility of stripping junior mortgages from your home that Chapter 7 doesn’t provide.

CHAPTER 13 FAQs

Chapter 13 FAQS

ANSWER:

Chapter 13 FAQS

ANSWER:

Chapter 13 FAQS

ANSWER:

Chapter 13 FAQS

ANSWER:

Chapter 13 FAQS

ANSWER:

Chapter 13 FAQS

ANSWER:

Chapter 13 FAQS

ANSWER:

Chapter 13 FAQS

ANSWER:

Chapter 13 FAQS

ANSWER:

Both Chapter 7 and Chapter 13 filers will need to attend a 341 Meeting of Creditors. Your creditors may appear, and they and your trustee will ask you questions about your petition. The hearing is typically relatively short and simple.

CONTACT US

Las Vegas Chapter 13 Bankruptcy Terms – FAQs

Chapter 13 FAQS

ANSWER:

Chapter 13 FAQS

ANSWER:

Chapter 13 FAQS

ANSWER:

Chapter 13 FAQS

ANSWER:

Chapter 13 FAQS

ANSWER:

Chapter 13 FAQS

ANSWER:

Chapter 13 FAQS

ANSWER: