Bankruptcy Filings Declining in the U.S.

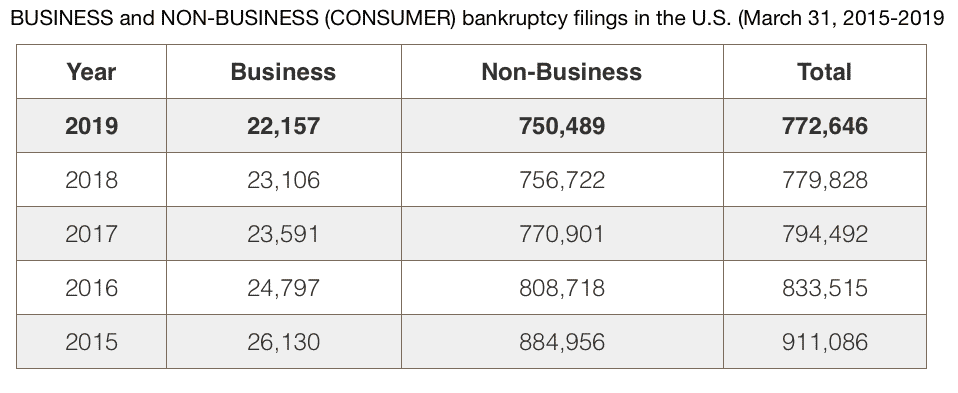

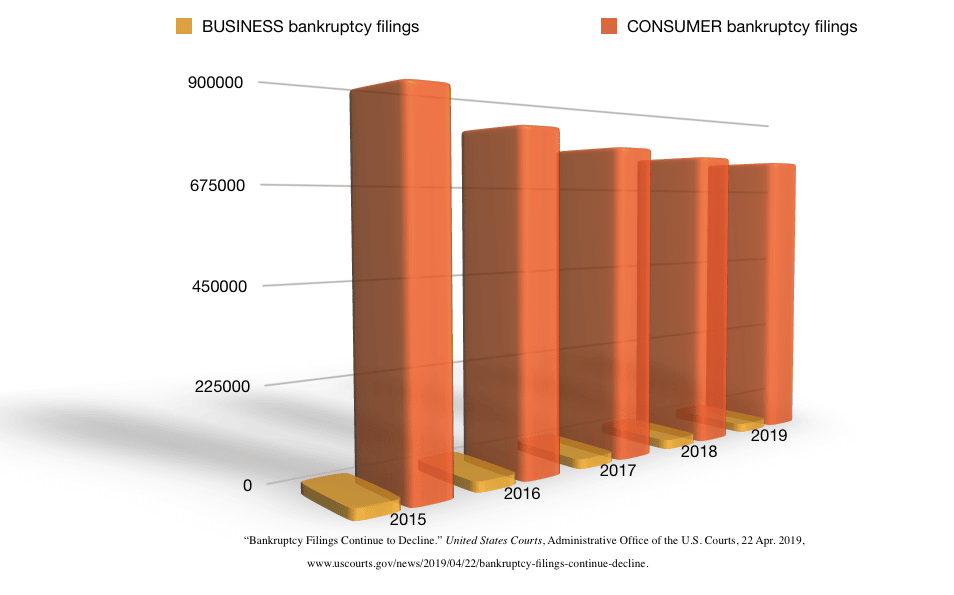

Bankruptcy filings in the U.S., according to the Administrative Office fo the United States Courts, were down .9% from March 2018 to March 2019. The statistics show a nation-wide declining trend since 2011. Bankruptcy cases peaked at almost 1.6 million in 2010, when data indicated an overall increase in filings from 2008-2011.

Eight years later, after the elevated number of bankruptcies in 2010, new bankruptcy filings have been cut in half. Compared to years past, consumer and business bankruptcies are at the lowest in almost a decade. It has been since 2007 that bankruptcy petitions filed has been this low.

Americans may not be pursuing bankruptcy, possibly, in part because of the cost to file. Also, people may not have the assets to protect. Filing a Chapter 7 bankruptcy involves court costs, lawyer fees, and debtor fees. In a Chapter 13, a repayment and debt reorganization plan is constructed which includes these fees. The debtor the course of the bankruptcy case pays back debt.

An item to note from the data is that older Americans are filing bankruptcy at a higher rate (possibly due to low income and high medical bills?). Also there is always the possibility of more consumer bankruptcy as more people enter the workforce and take on more credit.

Reports indicate a steady decline in filings in the last eight years. From 2007-2010, there was a steady rise in filings. The decline does correlate with the nine year bull run on Wall Street. Experts and Federal Reserve data point to bankruptcy trends following Americans’ debt-to-income ration. Americans are in a better position in 2019 to pay debt, even with record credit card debt, than they were during a recession.

Student loan debt may not be wiped out in a bankruptcy (unless “undue hardship” can be proven), and Americans owe $1.5 trillion in student loan debt. Filing a bankruptcy petition will not help with student loan debt. Efforts to repay this debt can certainly be overwhelming and cause financial problems. Typically, consumers ages 65+ filed more bankruptcies than ages 18-34 in the last decade.